Simplifying payroll & compliance management

Zenyo Payroll simplifies salary records and compliance handle for accurate payments, tax claims.

Excel without burdening Excels.

Try Free Now!

Request Demo

Automated PF Calculations

You needn't do any math. Zenyo Payroll automatically deducts the provident fund based on the employee's

salary range and PF Contribution rules. Maintain your clean compliance record, at the end of every payroll,

you get your copy of the PF calculations based on defined preferences.

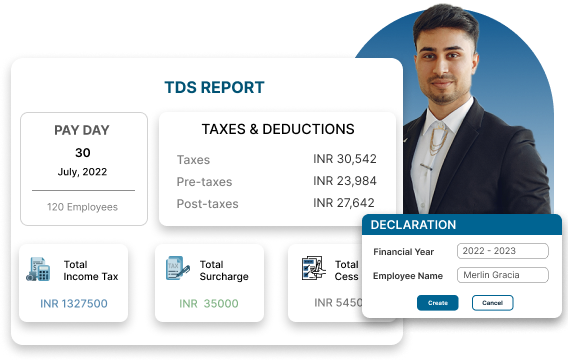

Hassle-free TDS & Compliance

Never worry about IT penalties, maintaining intricate breakups of deductions, POI's or filing TDS

returns. Zenyo Payroll makes it easy to keep your books up to date. Automatically calculates TDS deductions

for employees according to income tax slabs for the financial year.

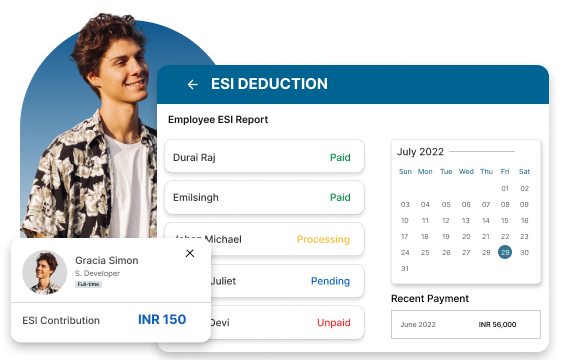

Timeless ESI filings

Save time and money on ESI computation and compliance with Zenyo Payroll for your full-time and contract

employees. Prepare your ESI summary report for periodic evaluation. Get a complete report on ESI employee

and employer contributions that meet the ESI office standards.

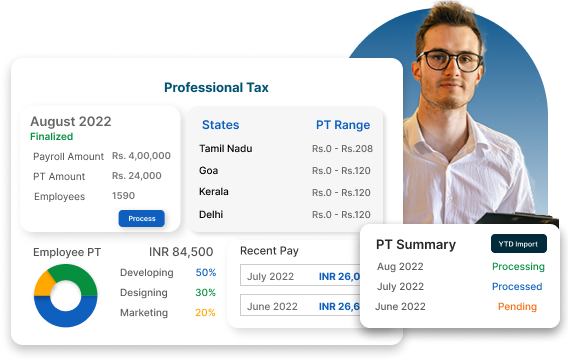

State-wise professional tax deduction

Got employees working in different states? Zenyo Payroll can automatically calculate professional tax

based on location and PT law. Zenyo calculates and deducts PT on the right schedule, whether it's every

month, half-yearly or yearly and generates the compliance form accordingly.